Autonomous Unmanned Underwater Vehicles (AUUV) Systems Integration Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities

- Executive Summary & Market Overview

- Key Technology Trends in AUUV Systems Integration

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Emerging Applications and Investment Hotspots

- Sources & References

Executive Summary & Market Overview

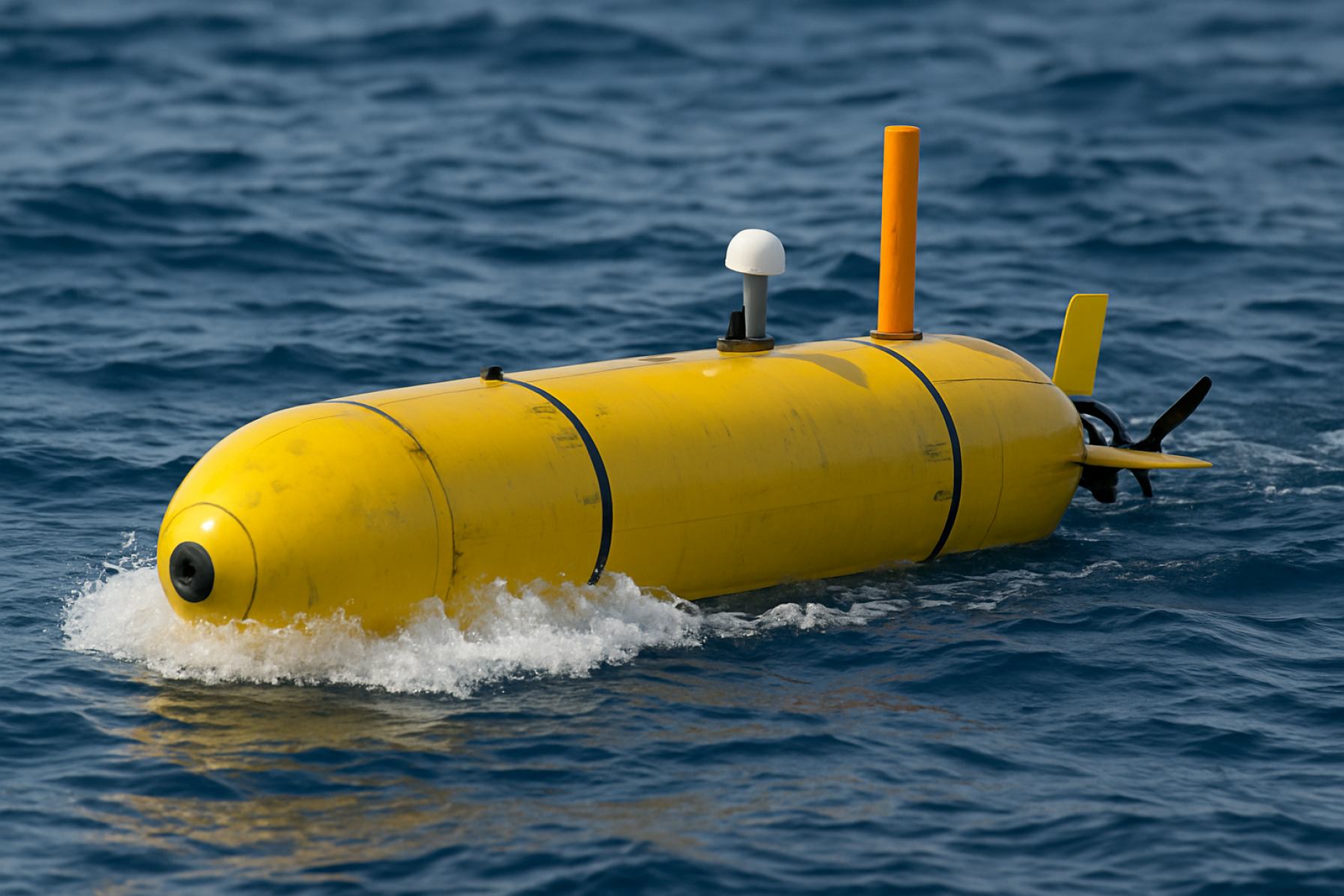

The Autonomous Unmanned Underwater Vehicles (AUUV) systems integration market is poised for significant growth in 2025, driven by advancements in underwater robotics, sensor fusion, and artificial intelligence. AUUV systems integration refers to the process of combining various subsystems—such as navigation, propulsion, communication, and payload modules—into a cohesive, interoperable platform capable of autonomous underwater operations. This integration is critical for enhancing mission flexibility, operational reliability, and data acquisition capabilities across defense, scientific, and commercial applications.

The global AUUV market is projected to reach a value of approximately USD 4.2 billion by 2025, expanding at a compound annual growth rate (CAGR) of over 12% from 2022 to 2025, according to MarketsandMarkets. The systems integration segment is a key enabler of this growth, as end-users increasingly demand modular, interoperable solutions that can be rapidly reconfigured for diverse missions such as seabed mapping, pipeline inspection, environmental monitoring, and anti-submarine warfare.

Defense remains the largest end-user segment, with navies worldwide investing in integrated AUUV systems for mine countermeasures, intelligence gathering, and surveillance. Notably, the U.S. Navy’s continued investment in large-displacement unmanned undersea vehicles (LDUUVs) and the European Union’s collaborative research initiatives are accelerating the adoption of advanced integration frameworks (U.S. Navy). Meanwhile, the commercial sector is witnessing increased uptake in offshore energy, subsea infrastructure inspection, and marine research, with companies like Saab and Kongsberg Maritime leading the integration of advanced autonomy and sensor suites.

Key market drivers include the miniaturization of sensors, improvements in underwater communication protocols, and the adoption of open architecture standards that facilitate multi-vendor interoperability. However, challenges persist in the form of high integration costs, cybersecurity risks, and the technical complexity of ensuring seamless operation in harsh underwater environments (Frost & Sullivan).

In summary, 2025 will see AUUV systems integration emerge as a critical differentiator in the underwater robotics market, enabling more sophisticated, reliable, and mission-adaptable platforms for both defense and commercial stakeholders.

Key Technology Trends in AUUV Systems Integration

In 2025, the integration of Autonomous Unmanned Underwater Vehicles (AUUV) systems is being shaped by several pivotal technology trends that are enhancing operational efficiency, mission flexibility, and data-driven decision-making. The convergence of advanced sensor fusion, artificial intelligence (AI), and robust communication protocols is at the forefront of these developments.

One of the most significant trends is the adoption of modular open systems architecture (MOSA), which allows for rapid integration of new payloads, sensors, and software modules. This approach is being championed by defense and commercial stakeholders alike, enabling AUUVs to be quickly reconfigured for diverse missions such as mine countermeasures, environmental monitoring, and subsea infrastructure inspection. The U.S. Navy, for example, has emphasized MOSA in its next-generation UUV programs to ensure interoperability and lifecycle cost reduction (U.S. Navy).

AI and machine learning are increasingly embedded within AUUV systems, driving advances in autonomous navigation, real-time threat detection, and adaptive mission planning. These capabilities are critical for operations in complex, dynamic underwater environments where GPS is unavailable and communication is limited. Companies like Saab and Kongsberg are integrating AI-driven autonomy to enable collaborative behaviors among multiple AUUVs, supporting swarm operations and distributed sensing.

Another key trend is the integration of high-bandwidth underwater communication technologies, such as optical and acoustic modems, which facilitate near-real-time data exchange between AUUVs and surface assets. This is essential for coordinated multi-vehicle missions and for transmitting large volumes of sensor data for rapid analysis (Teledyne Marine).

Energy management and power integration are also seeing innovation, with the adoption of advanced lithium-ion batteries, fuel cells, and energy harvesting systems. These technologies are extending mission endurance and enabling longer deployments without human intervention (Wood Mackenzie).

Finally, cybersecurity is becoming a core component of AUUV systems integration, as the risk of cyber threats to autonomous platforms grows. Secure communication protocols and resilient onboard processing are being prioritized to safeguard mission-critical data and vehicle control systems (National Institute of Standards and Technology).

Together, these technology trends are driving the evolution of AUUV systems integration, positioning the sector for expanded roles in defense, scientific research, and commercial applications in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for Autonomous Unmanned Underwater Vehicles (AUUV) systems integration in 2025 is characterized by a mix of established defense contractors, specialized marine technology firms, and emerging startups. The market is driven by increasing demand for advanced underwater surveillance, mine countermeasures, and subsea infrastructure inspection, with integration capabilities becoming a key differentiator among leading players.

Major defense contractors such as Northrop Grumman, Lockheed Martin, and Saab AB have leveraged their extensive experience in naval systems to offer highly integrated AUUV solutions. These companies focus on modular architectures, enabling rapid payload swaps and seamless interoperability with existing naval platforms. For instance, Saab AB’s Sabertooth and AUV62 platforms are recognized for their advanced sensor fusion and mission management systems, which are critical for multi-domain operations.

Specialized marine technology firms such as Kongsberg Maritime and Teledyne Marine have established themselves as leaders in sensor integration and autonomous navigation. Their AUUV systems are widely adopted for commercial and scientific applications, including offshore energy and environmental monitoring. Kongsberg Maritime’s HUGIN series, for example, is noted for its open architecture, allowing integration of third-party sensors and software, which appeals to both defense and civilian customers.

Emerging players and startups are also making significant inroads, particularly in the areas of artificial intelligence (AI) and swarm autonomy. Companies like Ocean Infinity are pioneering the use of AI-driven mission planning and real-time data analytics, enhancing the operational efficiency and adaptability of AUUV fleets. These innovations are increasingly being adopted by larger integrators through partnerships and acquisitions.

Strategic collaborations are a hallmark of the sector, with joint ventures and consortiums forming to address complex integration challenges. For example, the NATO Defence Innovation Accelerator for the North Atlantic (DIANA) program has fostered cross-border partnerships to accelerate AUUV systems integration for defense applications.

Overall, the AUUV systems integration market in 2025 is marked by intense competition, rapid technological advancement, and a growing emphasis on open, interoperable architectures. Leading players are distinguished by their ability to deliver flexible, scalable solutions that meet the evolving needs of both military and commercial end-users.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The market for Autonomous Unmanned Underwater Vehicles (AUUV) systems integration is poised for robust growth between 2025 and 2030, driven by escalating demand for advanced underwater surveillance, oceanographic research, and offshore energy operations. According to projections by MarketsandMarkets, the global AUUV market is expected to register a compound annual growth rate (CAGR) of approximately 13% during this period, with systems integration representing a significant value-add segment as end-users seek seamless interoperability and mission-specific customization.

Revenue from AUUV systems integration is forecasted to surpass USD 2.5 billion by 2030, up from an estimated USD 1.1 billion in 2025. This surge is attributed to the increasing complexity of AUUV missions, which require integration of advanced sensors, communication modules, and AI-driven navigation systems. The defense sector remains the largest revenue contributor, accounting for over 55% of integration contracts, as navies worldwide invest in multi-mission AUUV fleets for mine countermeasures, anti-submarine warfare, and intelligence gathering. The commercial sector, particularly offshore oil & gas and subsea infrastructure inspection, is projected to witness the fastest growth, with a CAGR exceeding 15% through 2030, as reported by Fortune Business Insights.

In terms of volume, the annual deployment of integrated AUUV systems is expected to reach approximately 2,800 units by 2030, up from around 1,200 units in 2025. This growth is underpinned by technological advancements in modular payloads and open-architecture platforms, enabling rapid integration and deployment for diverse applications. North America and Europe are anticipated to maintain their dominance in both revenue and volume, supported by strong government funding and a mature ecosystem of AUUV integrators. However, the Asia-Pacific region is emerging as a high-growth market, with countries like China, South Korea, and Australia ramping up investments in indigenous AUUV integration capabilities, as highlighted by IDTechEx.

Overall, the 2025–2030 period will see AUUV systems integration evolve from bespoke, project-based solutions to scalable, standardized offerings, with market leaders focusing on interoperability, autonomy, and lifecycle support to capture a growing share of this dynamic sector.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for Autonomous Unmanned Underwater Vehicles (AUUV) systems integration is experiencing differentiated growth across regions, driven by varying defense priorities, commercial applications, and technological capabilities. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present unique dynamics shaping the integration of AUUV systems.

North America remains the largest and most mature market for AUUV systems integration, underpinned by substantial investments from the United States Navy and Department of Defense. The focus is on advanced sensor fusion, AI-driven autonomy, and seamless integration with existing naval platforms. The U.S. is accelerating programs such as the Large Displacement Unmanned Undersea Vehicle (LDUUV) and leveraging partnerships with leading defense contractors to enhance interoperability and mission flexibility. Canada is also investing in AUUVs for Arctic surveillance and resource monitoring, albeit at a smaller scale. According to U.S. Navy and Lockheed Martin, North American integration efforts emphasize modularity and rapid deployment capabilities.

Europe is characterized by collaborative R&D initiatives and a growing emphasis on dual-use (military and civilian) applications. The European Defence Fund and national programs in the UK, France, and Norway are driving integration of AUUVs for anti-submarine warfare, mine countermeasures, and environmental monitoring. European integrators focus on interoperability within NATO frameworks and compliance with stringent safety and data standards. Companies such as Saab and Leonardo are at the forefront, developing scalable architectures for multi-vehicle operations.

- Asia-Pacific is witnessing the fastest growth, propelled by maritime security concerns and territorial disputes in the South China Sea and East China Sea. China, Japan, South Korea, and Australia are investing heavily in indigenous AUUV development and integration. The region’s focus is on swarm technologies, long-endurance missions, and integration with satellite and surface assets. According to CSIS, China’s rapid advancements in underwater autonomy and networked operations are reshaping regional dynamics.

- Rest of World (RoW) includes emerging markets in the Middle East, Latin America, and Africa, where AUUV integration is primarily driven by offshore energy exploration, environmental monitoring, and nascent defense modernization. Adoption is slower due to budget constraints and limited technical expertise, but partnerships with global integrators are facilitating technology transfer and capacity building, as noted by S&P Global (IHS Markit).

Overall, 2025 will see continued regional divergence in AUUV systems integration, with North America and Asia-Pacific leading in defense-driven innovation, Europe focusing on interoperability and dual-use, and RoW gradually expanding through commercial and collaborative initiatives.

Challenges, Risks, and Barriers to Adoption

The integration of Autonomous Unmanned Underwater Vehicles (AUUV) systems faces a complex array of challenges, risks, and barriers that could impede widespread adoption by 2025. One of the primary technical challenges is interoperability. AUUVs often need to operate in conjunction with legacy systems, other autonomous platforms, and diverse communication protocols. Achieving seamless integration requires standardized interfaces and robust middleware, which are still under development and lack universal adoption across the industry (NATO).

Another significant barrier is underwater communication. Unlike terrestrial or aerial autonomous systems, AUUVs operate in an environment where radio frequency signals are severely attenuated. Acoustic communication, the primary alternative, suffers from low bandwidth, high latency, and susceptibility to environmental noise. These limitations complicate real-time data sharing and coordinated operations, increasing the risk of mission failure or data loss (Ocean News & Technology).

Cybersecurity risks are also heightened in AUUV system integration. As these vehicles become more networked and reliant on software-driven controls, they present a larger attack surface for potential cyber threats. The lack of standardized security protocols for underwater systems further exacerbates this risk, raising concerns about data integrity, mission reliability, and even the potential for hostile takeover of assets (National Institute of Standards and Technology (NIST)).

Operational risks include navigation and localization challenges. The absence of GPS signals underwater forces AUUVs to rely on inertial navigation systems, Doppler velocity logs, and acoustic positioning, all of which can accumulate errors over time or be disrupted by environmental factors. This can lead to mission drift, loss of vehicle, or collision with subsea infrastructure (Wood Mackenzie).

Finally, regulatory and legal barriers persist. The lack of clear international standards and regulatory frameworks for AUUV operations creates uncertainty for manufacturers and end-users. Issues such as liability in case of accidents, data ownership, and cross-border operations remain unresolved, slowing commercial adoption and investment (International Maritime Organization (IMO)).

Opportunities and Strategic Recommendations

The integration of Autonomous Unmanned Underwater Vehicles (AUUV) systems presents significant opportunities for stakeholders across defense, commercial, and research sectors in 2025. As AUUVs become increasingly sophisticated, the demand for seamless interoperability with existing maritime platforms, advanced sensor payloads, and robust communication networks is accelerating. This trend is driven by the need for multi-mission flexibility, real-time data transmission, and enhanced situational awareness in complex underwater environments.

Opportunities:

- Defense Modernization: Navies worldwide are prioritizing the integration of AUUVs with surface ships, submarines, and command centers to enable coordinated anti-submarine warfare, mine countermeasures, and intelligence gathering. The U.S. Navy’s investment in modular open systems architecture for unmanned platforms exemplifies this shift, creating opportunities for system integrators and software developers to deliver interoperable solutions (U.S. Navy).

- Commercial Expansion: The offshore energy sector is increasingly adopting AUUVs for pipeline inspection, subsea infrastructure monitoring, and environmental surveys. Integration with cloud-based analytics and digital twin platforms allows operators to optimize asset management and reduce operational costs (Wood Mackenzie).

- Research Collaboration: Oceanographic institutions are leveraging integrated AUUV systems for deep-sea exploration and climate monitoring. Partnerships between technology providers and research organizations are fostering innovation in sensor fusion and autonomous mission planning (Woods Hole Oceanographic Institution).

Strategic Recommendations:

- Invest in Open Architecture: Companies should prioritize open standards and modular designs to facilitate integration with diverse platforms and payloads, ensuring future-proofing and scalability.

- Enhance Cybersecurity: As AUUVs become more networked, robust cybersecurity protocols are essential to protect mission-critical data and prevent unauthorized access (National Institute of Standards and Technology).

- Foster Cross-Sector Partnerships: Collaboration between defense, commercial, and academic stakeholders can accelerate technology transfer and drive down integration costs.

- Leverage AI and Edge Computing: Integrating artificial intelligence and edge processing capabilities will enable real-time decision-making and autonomy, reducing reliance on surface communications (Gartner).

In summary, AUUV systems integration in 2025 offers robust growth prospects for agile players who can deliver interoperable, secure, and intelligent solutions tailored to evolving maritime missions.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for Autonomous Unmanned Underwater Vehicles (AUUV) systems integration in 2025 is shaped by rapid technological advancements, expanding application domains, and a surge in strategic investments. As AUUVs become more sophisticated, the integration of subsystems—such as advanced sensors, AI-driven navigation, and real-time data transmission—will be pivotal in unlocking new capabilities and market opportunities.

Emerging applications are driving demand for seamless systems integration. In the defense sector, navies are increasingly deploying AUUVs for mine countermeasures, anti-submarine warfare, and intelligence gathering, necessitating robust integration of sonar, communication, and propulsion systems. The commercial sector is witnessing a parallel trend, with AUUVs being integrated into offshore oil and gas inspection, subsea infrastructure monitoring, and environmental assessment workflows. The ability to combine high-resolution imaging, autonomous decision-making, and cloud-based analytics is becoming a key differentiator for solution providers.

Investment hotspots are emerging in regions and sectors where AUUV integration can address critical operational challenges. North America and Europe remain at the forefront, driven by defense modernization programs and offshore energy exploration. Notably, the Asia-Pacific region is rapidly catching up, with countries like China, Japan, and South Korea investing heavily in maritime security and deep-sea research capabilities. According to MarketsandMarkets, the global UUV market is projected to reach $7.0 billion by 2025, with a significant share attributed to integrated AUUV systems.

- AI and Edge Computing: Integration of AI and edge computing is enabling real-time data processing and adaptive mission planning, reducing reliance on surface support vessels.

- Interoperability Standards: Industry-wide efforts to develop open architecture standards are facilitating plug-and-play integration of payloads and software, accelerating innovation cycles.

- Dual-Use Technologies: Cross-sector investments, particularly from defense and energy, are fostering the development of dual-use AUUV platforms that can be rapidly reconfigured for diverse missions.

Looking ahead to 2025, the AUUV systems integration landscape will be characterized by increased collaboration between OEMs, software developers, and end-users. Strategic partnerships and M&A activity are expected to intensify, as companies seek to build comprehensive, interoperable solutions. The convergence of autonomy, connectivity, and modularity will define the next wave of AUUV innovation, positioning integrated systems as the cornerstone of future underwater operations.

Sources & References

- MarketsandMarkets

- Saab

- Kongsberg Maritime

- Frost & Sullivan

- Teledyne Marine

- Wood Mackenzie

- National Institute of Standards and Technology

- Northrop Grumman

- Lockheed Martin

- Ocean Infinity

- Fortune Business Insights

- IDTechEx

- Leonardo

- CSIS

- International Maritime Organization (IMO)