Ferroelectric RF Filter Manufacturing in 2025: Pioneering Next-Gen Wireless Connectivity and Market Expansion. Explore How Advanced Materials and Design Are Shaping the Future of High-Frequency Communications.

- Executive Summary: Key Trends and Market Drivers in 2025

- Ferroelectric Materials: Innovations and Performance Advantages

- Current State of RF Filter Manufacturing Technologies

- Major Players and Strategic Partnerships (e.g., murata.com, qorvo.com, ieee.org)

- Market Size, Segmentation, and 2025–2030 Growth Forecasts

- Application Landscape: 5G, IoT, Automotive, and Beyond

- Supply Chain Dynamics and Regional Manufacturing Hubs

- Challenges: Scalability, Cost, and Integration with Existing Systems

- Emerging Research, Patents, and Standardization Efforts (e.g., ieee.org)

- Future Outlook: Disruptive Opportunities and Long-Term Industry Impact

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

The ferroelectric RF filter manufacturing sector is poised for significant transformation in 2025, driven by the accelerating deployment of 5G and the early groundwork for 6G wireless networks. Ferroelectric materials, particularly barium strontium titanate (BST), are increasingly favored for their tunable dielectric properties, enabling compact, high-performance RF filters that address the stringent requirements of next-generation wireless infrastructure. The demand for these filters is being propelled by the need for higher data rates, lower latency, and more efficient spectrum utilization in mobile devices, base stations, and IoT applications.

Key industry players are scaling up production and refining manufacturing processes to meet the surging demand. Murata Manufacturing Co., Ltd., a global leader in electronic components, continues to invest in advanced ferroelectric material processing and thin-film deposition techniques, aiming to enhance filter performance and yield. TDK Corporation is also expanding its portfolio of tunable RF components, leveraging its expertise in materials science and multilayer ceramic integration. These companies are focusing on miniaturization and integration, which are critical for supporting the proliferation of multi-band, multi-mode devices.

Another notable trend is the increasing collaboration between device manufacturers and network equipment providers to co-develop application-specific ferroelectric RF filters. Qorvo, Inc. and Skyworks Solutions, Inc. are actively engaged in partnerships to accelerate the commercialization of tunable filter solutions tailored for 5G and emerging 6G use cases. These collaborations are expected to shorten development cycles and ensure that filter designs align closely with evolving network standards.

On the technology front, advances in atomic layer deposition (ALD) and sputtering are enabling more precise control over ferroelectric film thickness and uniformity, directly impacting device performance and reliability. The integration of ferroelectric RF filters with system-in-package (SiP) and monolithic microwave integrated circuit (MMIC) platforms is also gaining momentum, supporting the trend toward highly integrated, space-saving modules for mobile and infrastructure applications.

Looking ahead, the market outlook for ferroelectric RF filter manufacturing remains robust. The sector is expected to benefit from continued investment in 5G infrastructure, the expansion of private wireless networks, and the anticipated rollout of 6G pilot projects by the late 2020s. As manufacturers optimize production yields and scale up capacity, ferroelectric RF filters are set to play a pivotal role in enabling the next wave of wireless innovation.

Ferroelectric Materials: Innovations and Performance Advantages

Ferroelectric materials have emerged as a transformative technology in the manufacturing of RF (radio frequency) filters, offering significant performance advantages over traditional dielectric and piezoelectric counterparts. As of 2025, the integration of ferroelectric thin films—particularly barium strontium titanate (BST) and lead zirconate titanate (PZT)—is enabling the development of tunable RF filters with enhanced selectivity, miniaturization, and power efficiency. These materials exhibit a high dielectric constant and tunability under applied electric fields, which is critical for dynamic frequency selection in 5G, Wi-Fi 6E, and emerging 6G wireless systems.

Key industry players are advancing the commercialization of ferroelectric RF filter technology. Murata Manufacturing Co., Ltd. has been at the forefront, leveraging its expertise in multilayer ceramic technology to develop compact, high-performance RF components. Murata’s ongoing research into BST-based tunable devices is aimed at meeting the stringent requirements of next-generation mobile and IoT applications. Similarly, TDK Corporation is investing in the mass production of ferroelectric thin films, focusing on scalable manufacturing processes that ensure consistent material quality and device reliability.

In the United States, Qorvo, Inc. and Skyworks Solutions, Inc. are exploring the integration of ferroelectric materials into their RF front-end modules. Qorvo’s research highlights the potential for BST-based varactors to enable agile, low-loss filter architectures, which are essential for carrier aggregation and spectrum sharing in advanced wireless networks. Skyworks is similarly investigating ferroelectric tunable capacitors to address the growing demand for reconfigurable RF solutions in smartphones and connected devices.

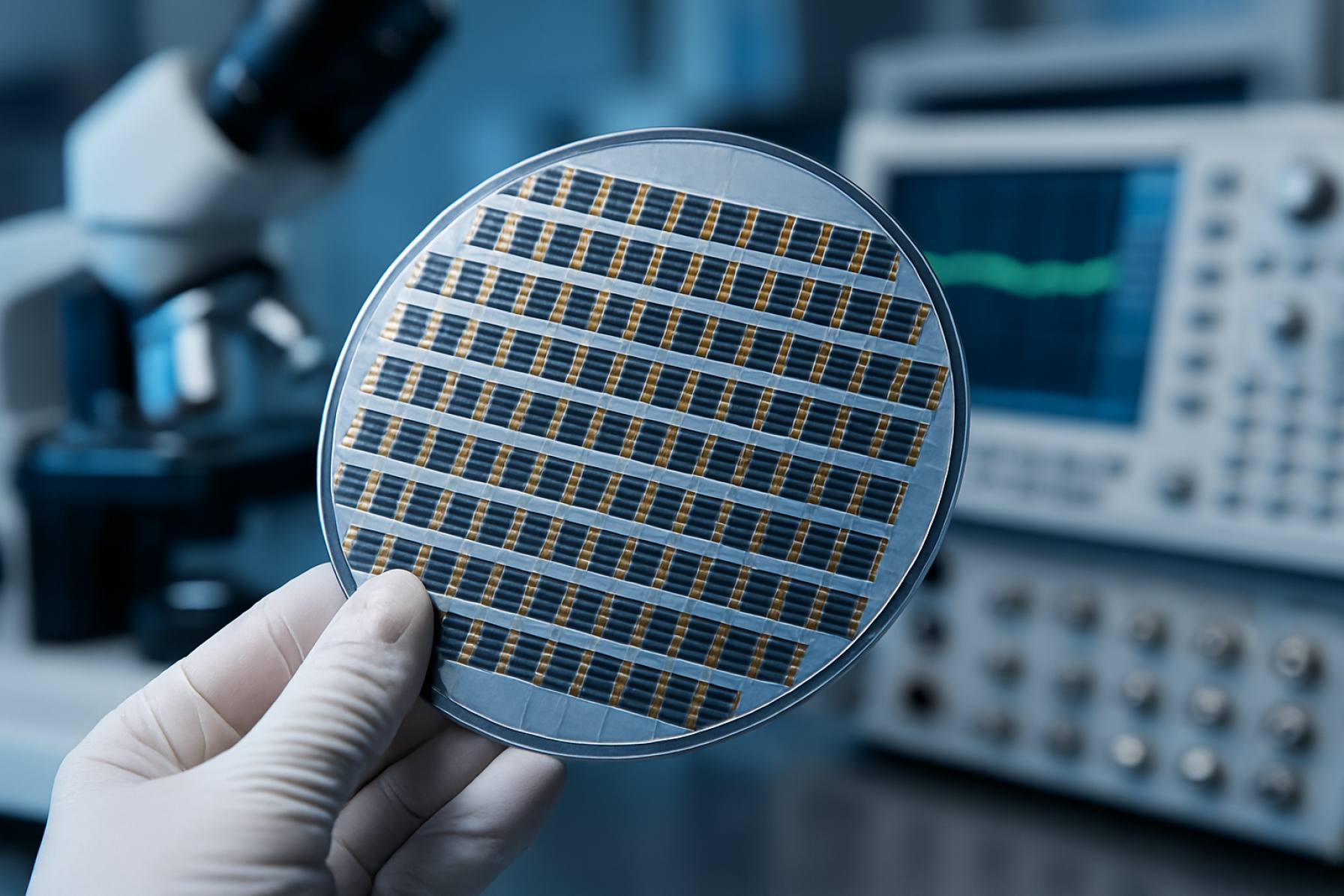

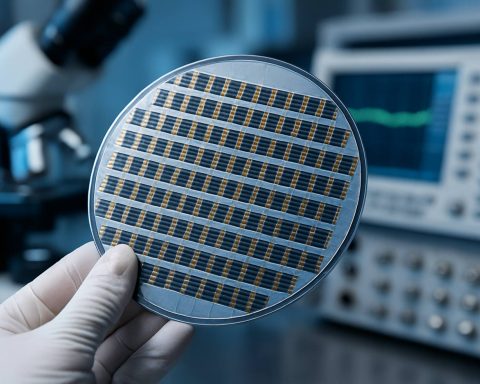

Manufacturing innovations are centered on improving the deposition and patterning of ferroelectric films at wafer scale. Techniques such as metal-organic chemical vapor deposition (MOCVD) and pulsed laser deposition (PLD) are being refined to achieve uniform film thickness, low defect densities, and high yield. These advances are critical for scaling up production and reducing costs, making ferroelectric RF filters more accessible for mass-market applications.

Looking ahead, the outlook for ferroelectric RF filter manufacturing is robust. The continued evolution of wireless standards and the proliferation of connected devices are expected to drive demand for tunable, high-performance RF filters. Industry collaborations and investments in material science are likely to yield further improvements in device efficiency, linearity, and integration, positioning ferroelectric materials as a cornerstone of future RF front-end architectures.

Current State of RF Filter Manufacturing Technologies

Ferroelectric RF filter manufacturing is emerging as a promising technology in the broader landscape of radio frequency (RF) filter production, particularly as the demand for high-performance, tunable, and miniaturized components intensifies with the rollout of 5G and the development of 6G wireless systems. As of 2025, the sector is characterized by a blend of established ceramic filter manufacturers and innovative entrants leveraging advances in ferroelectric materials, such as barium strontium titanate (BST) and lead zirconate titanate (PZT), to deliver tunable and reconfigurable RF filters.

Traditional RF filter technologies, including surface acoustic wave (SAW) and bulk acoustic wave (BAW) filters, have dominated the market due to their maturity and integration in mobile devices. However, these technologies face limitations in terms of tunability and size reduction, especially as frequency bands proliferate and spectrum allocation becomes more dynamic. Ferroelectric materials, with their voltage-dependent permittivity, offer a pathway to electrically tunable filters that can adapt to changing frequency requirements in real time, a feature increasingly sought after in next-generation wireless infrastructure.

Key players in the ferroelectric RF filter manufacturing space include Murata Manufacturing Co., Ltd., which has a long-standing presence in ceramic and advanced material components, and TDK Corporation, known for its research and development in electronic materials and components. Both companies have invested in the development of tunable RF components, including those based on ferroelectric materials, to address the needs of 5G and beyond. KEMET Corporation (a subsidiary of Yageo Corporation) is also active in the field, leveraging its expertise in advanced ceramics to explore ferroelectric-based solutions for RF applications.

Manufacturing processes for ferroelectric RF filters typically involve thin-film deposition techniques such as sputtering or chemical vapor deposition to create high-quality ferroelectric layers on substrates like silicon or sapphire. These processes are being refined to improve yield, uniformity, and integration with standard semiconductor manufacturing workflows. The industry is also witnessing collaborations between material suppliers, device manufacturers, and wireless infrastructure companies to accelerate the commercialization of ferroelectric RF filters.

Looking ahead, the outlook for ferroelectric RF filter manufacturing is positive, with expectations of increased adoption in both infrastructure and user equipment as performance and reliability benchmarks are met. The ability to deliver compact, tunable, and energy-efficient filters positions ferroelectric technology as a key enabler for the flexible and high-capacity networks envisioned for the coming years.

Major Players and Strategic Partnerships (e.g., murata.com, qorvo.com, ieee.org)

The landscape of ferroelectric RF filter manufacturing in 2025 is shaped by a select group of major players, each leveraging advanced materials science and strategic collaborations to address the surging demand for high-performance wireless components. These filters, essential for 5G, Wi-Fi 6/7, and emerging wireless standards, rely on tunable ferroelectric materials to achieve superior selectivity, miniaturization, and power efficiency.

Among the global leaders, Murata Manufacturing Co., Ltd. stands out for its deep expertise in ceramic and ferroelectric material processing. Murata’s ongoing investments in R&D and manufacturing capacity have enabled it to supply high-volume, high-reliability RF filters for smartphones, base stations, and IoT devices. The company’s strategic partnerships with semiconductor foundries and wireless module integrators have further solidified its position in the supply chain, with recent announcements highlighting collaborations to co-develop next-generation tunable filter modules for 5G and beyond.

Qorvo, Inc. is another key player, recognized for its portfolio of RF front-end solutions that incorporate ferroelectric and other advanced materials. Qorvo’s manufacturing capabilities span both bulk acoustic wave (BAW) and surface acoustic wave (SAW) technologies, with ongoing research into integrating ferroelectric thin films for tunable filter applications. The company has entered into multiple joint development agreements with leading wireless infrastructure providers and has announced plans to expand its filter manufacturing lines in North America and Asia to meet projected demand through 2027.

In the United States, Skyworks Solutions, Inc. is actively developing ferroelectric-based tunable filters, leveraging its expertise in RF system integration. Skyworks has formed strategic alliances with material suppliers and device manufacturers to accelerate the commercialization of high-frequency, low-loss filter solutions for 5G handsets and automotive connectivity.

On the research and standardization front, organizations such as the IEEE play a pivotal role in fostering collaboration between academia, industry, and government. IEEE’s technical committees and conferences provide a platform for major players to share breakthroughs in ferroelectric material science, device reliability, and scalable manufacturing processes, accelerating the adoption of these technologies in commercial products.

Looking ahead, the next few years are expected to see intensified collaboration between filter manufacturers, foundries, and wireless OEMs. The focus will be on scaling up production, improving yield and uniformity of ferroelectric films, and developing new device architectures to support the ever-increasing complexity of wireless spectrum management. As 6G research accelerates, these partnerships will be critical in maintaining technological leadership and meeting the stringent requirements of future wireless networks.

Market Size, Segmentation, and 2025–2030 Growth Forecasts

The global market for ferroelectric RF (radio frequency) filter manufacturing is poised for significant growth from 2025 through 2030, driven by the rapid expansion of 5G and emerging 6G wireless infrastructure, as well as increasing demand for high-performance, miniaturized components in mobile devices and IoT applications. Ferroelectric RF filters, leveraging materials such as barium strontium titanate (BST), offer tunability, low insertion loss, and high linearity, making them attractive for next-generation wireless systems.

Market segmentation is primarily based on end-use application (mobile devices, base stations, automotive, IoT, and defense), filter type (bulk acoustic wave, surface acoustic wave, and tunable filters), and geographic region. The mobile device segment remains the largest consumer, as smartphone manufacturers seek to integrate more frequency bands and advanced features. However, the infrastructure segment—especially 5G and future 6G base stations—is expected to see the fastest growth, as network operators deploy more complex and flexible RF front ends.

Key players in ferroelectric RF filter manufacturing include Murata Manufacturing Co., Ltd., a global leader in electronic components, which has invested in tunable RF solutions for mobile and infrastructure markets. TDK Corporation is another major manufacturer, leveraging its expertise in advanced materials and thin-film technologies to develop high-performance RF filters. Qorvo, Inc. and Skyworks Solutions, Inc. are also active in the sector, focusing on integrating ferroelectric materials into their RF front-end modules for smartphones and wireless infrastructure.

From 2025 to 2030, the market is expected to experience a compound annual growth rate (CAGR) in the high single digits, with Asia-Pacific leading due to the concentration of smartphone manufacturing and rapid 5G/6G rollout. North America and Europe are also significant markets, driven by investments in advanced wireless infrastructure and automotive connectivity. The adoption of tunable ferroelectric filters is anticipated to accelerate as device makers seek to reduce component count and improve spectral efficiency.

Looking ahead, ongoing R&D in ferroelectric materials and scalable manufacturing processes will be critical for cost reduction and performance improvements. Industry collaborations and partnerships between material suppliers, foundries, and OEMs are expected to intensify, as companies like Murata Manufacturing Co., Ltd. and TDK Corporation continue to expand their product portfolios and production capacities to meet growing demand.

Application Landscape: 5G, IoT, Automotive, and Beyond

The application landscape for ferroelectric RF filter manufacturing is rapidly evolving, driven by the expanding demands of 5G, IoT, automotive, and emerging wireless technologies. As of 2025, the integration of ferroelectric materials—such as barium strontium titanate (BST)—into RF filters is gaining momentum due to their tunability, miniaturization potential, and low power consumption. These attributes are particularly valuable in the context of 5G networks, which require agile, high-performance filtering solutions to manage increasingly crowded and dynamic spectrum environments.

In the 5G sector, ferroelectric RF filters are being adopted to address the need for reconfigurable and adaptive filtering in both sub-6 GHz and mmWave bands. Companies like Murata Manufacturing Co., Ltd. and TDK Corporation are at the forefront, leveraging their expertise in advanced materials and thin-film processing to develop compact, high-Q tunable filters. These filters enable dynamic spectrum allocation and interference mitigation, which are critical for network densification and carrier aggregation in urban deployments.

The Internet of Things (IoT) is another major driver, with billions of connected devices requiring cost-effective, low-power RF front ends. Ferroelectric filters, with their ability to be integrated monolithically with CMOS circuits, offer a pathway to highly integrated, energy-efficient modules. Qorvo, Inc. and Skyworks Solutions, Inc. are actively exploring ferroelectric-based solutions to meet the stringent size and power requirements of IoT endpoints, particularly in industrial and smart home applications.

In the automotive sector, the proliferation of advanced driver-assistance systems (ADAS), vehicle-to-everything (V2X) communications, and in-cabin connectivity is fueling demand for robust, high-frequency RF filters. Ferroelectric technology’s inherent tunability and thermal stability make it attractive for automotive-grade applications, where operating conditions can be harsh and requirements for reliability are stringent. Companies such as TDK Corporation and Murata Manufacturing Co., Ltd. are investing in automotive-qualified ferroelectric filter solutions, targeting both infotainment and safety-critical communication systems.

Looking ahead, the next few years are expected to see further advances in ferroelectric material engineering, wafer-level packaging, and integration with silicon platforms. This will likely expand the application scope to include satellite communications, defense, and next-generation wireless standards beyond 5G. The ongoing collaboration between material suppliers, foundries, and system integrators is poised to accelerate commercialization, with industry leaders such as Qorvo, Inc. and Skyworks Solutions, Inc. expected to play pivotal roles in shaping the future landscape of ferroelectric RF filter manufacturing.

Supply Chain Dynamics and Regional Manufacturing Hubs

The supply chain for ferroelectric RF filter manufacturing in 2025 is characterized by a complex interplay of material sourcing, advanced fabrication processes, and regional specialization. Ferroelectric RF filters, which leverage tunable dielectric properties for high-performance signal filtering in wireless communications, are increasingly critical for 5G and emerging 6G networks. The manufacturing ecosystem is shaped by the availability of high-purity ferroelectric materials, precision thin-film deposition technologies, and the integration of these components into compact, high-frequency modules.

Key supply chain nodes include suppliers of barium strontium titanate (BST) and other ferroelectric ceramics, as well as companies specializing in sputtering, chemical vapor deposition, and photolithography. The United States remains a leader in ferroelectric material innovation and device design, with companies such as Murata Manufacturing Co., Ltd. and Qorvo, Inc. investing in both R&D and domestic production capacity. Murata Manufacturing Co., Ltd. is notable for its vertically integrated approach, controlling much of its own material supply and device assembly, which helps mitigate risks from global supply chain disruptions.

In Asia, Japan and South Korea are prominent manufacturing hubs, leveraging established expertise in ceramics and microelectronics. Japanese firms such as Murata Manufacturing Co., Ltd. and TDK Corporation have expanded their ferroelectric RF filter production lines to meet growing demand from smartphone and infrastructure OEMs. South Korea’s Samsung Electronics is also investing in advanced RF front-end modules, integrating ferroelectric filter technology into its semiconductor supply chain.

China is rapidly scaling its capabilities, with state-backed initiatives to localize the production of key materials and components. Companies such as San’an Optoelectronics are increasing their presence in the RF device market, supported by government incentives aimed at reducing reliance on imported technologies. This regional diversification is leading to a more resilient, albeit competitive, global supply chain.

Looking ahead, the supply chain for ferroelectric RF filters is expected to become more robust as manufacturers invest in automation, quality control, and local sourcing of critical materials. Strategic partnerships between material suppliers and device manufacturers are likely to intensify, particularly as demand for high-frequency, low-loss filters accelerates with the rollout of 5G-Advanced and early 6G deployments. Regional hubs in the US, Japan, South Korea, and China will continue to play pivotal roles, with ongoing efforts to secure supply chains against geopolitical and logistical risks.

Challenges: Scalability, Cost, and Integration with Existing Systems

Ferroelectric RF filter manufacturing faces several critical challenges as the technology moves from research labs toward commercial deployment in 2025 and the coming years. The most pressing issues are scalability of production, cost competitiveness, and seamless integration with existing RF system architectures.

Scalability remains a significant hurdle. Ferroelectric materials, such as barium strontium titanate (BST), require precise deposition and patterning techniques to achieve the desired tunability and low-loss characteristics. While laboratory-scale processes like pulsed laser deposition and chemical solution deposition have demonstrated promising device performance, scaling these methods to high-throughput, wafer-level manufacturing is complex and capital-intensive. Leading manufacturers, including Murata Manufacturing Co., Ltd. and TDK Corporation, have invested in advanced thin-film deposition and lithography infrastructure, but achieving consistent yield and uniformity across large substrates remains a technical bottleneck.

Cost is closely tied to scalability. The specialized equipment and materials required for ferroelectric thin-film processing drive up initial capital expenditures and per-unit costs compared to established RF filter technologies such as surface acoustic wave (SAW) and bulk acoustic wave (BAW) filters. As of 2025, the cost gap is narrowing, but ferroelectric RF filters are still primarily targeted at high-performance, niche applications where their tunability and miniaturization offer clear advantages. Companies like KEMET (a Yageo company) and Qorvo, Inc. are actively developing cost-reduction strategies, including process optimization and integration with standard CMOS fabrication lines, to make ferroelectric filters more competitive for mass-market adoption.

Integration with existing RF systems presents another layer of complexity. Ferroelectric RF filters must be compatible with the electrical, thermal, and mechanical environments of modern wireless devices, including smartphones, base stations, and IoT modules. This requires not only miniaturization but also robust packaging and interconnect solutions. Industry leaders such as Murata Manufacturing Co., Ltd. and TDK Corporation are leveraging their expertise in multilayer ceramic integration and advanced packaging to address these challenges. However, ensuring long-term reliability and performance stability under varying operating conditions remains an active area of research and development.

Looking ahead, the outlook for overcoming these challenges is cautiously optimistic. Ongoing investments in manufacturing infrastructure, materials science, and process integration are expected to yield incremental improvements in yield, cost, and system compatibility over the next few years. As 5G and emerging 6G networks demand ever more agile and compact RF front-ends, the pressure to resolve these manufacturing challenges will intensify, driving further innovation and collaboration across the supply chain.

Emerging Research, Patents, and Standardization Efforts (e.g., ieee.org)

The landscape of ferroelectric RF filter manufacturing is rapidly evolving, driven by the demand for high-performance, tunable, and miniaturized components in 5G, Wi-Fi 6/7, and emerging wireless standards. In 2025, research efforts are intensifying around new ferroelectric materials—such as barium strontium titanate (BST) and lead zirconate titanate (PZT)—which offer superior tunability and low-loss characteristics essential for next-generation RF filters. Leading manufacturers and research institutions are actively filing patents and publishing results on novel deposition techniques, device architectures, and integration methods to enhance filter performance and manufacturability.

Key industry players like Murata Manufacturing Co., Ltd. and TDK Corporation are at the forefront of commercializing ferroelectric-based RF components. Both companies have a strong track record in multilayer ceramic and thin-film technologies, and are now investing in scalable processes for integrating ferroelectric materials onto silicon and other substrates. Murata Manufacturing Co., Ltd. has announced ongoing research into BST-based tunable filters, aiming to address the growing complexity of carrier aggregation and dynamic spectrum allocation in mobile devices. Similarly, TDK Corporation is leveraging its expertise in thin-film piezoelectric materials to develop compact, high-Q RF filters suitable for advanced wireless front-ends.

On the intellectual property front, patent filings related to ferroelectric RF filter structures, manufacturing methods, and integration with CMOS processes have surged since 2023. Companies such as Qorvo, Inc. and Skyworks Solutions, Inc. are actively expanding their patent portfolios in this domain, focusing on tunable filter arrays and adaptive RF front-end modules. These patents often cover innovations in material composition, electrode design, and process integration, reflecting the competitive push to secure foundational technologies for future wireless infrastructure.

Standardization efforts are also gaining momentum. The IEEE is facilitating working groups and technical committees to define performance metrics, reliability standards, and test methodologies for ferroelectric RF devices. These initiatives are crucial for ensuring interoperability and accelerating the adoption of ferroelectric filters in commercial wireless systems. In parallel, industry consortia and alliances are collaborating to address supply chain challenges and promote best practices in ferroelectric material sourcing and device fabrication.

Looking ahead, the next few years are expected to see further convergence between academic research, industrial R&D, and standardization bodies. As 6G and beyond wireless technologies emerge, the role of ferroelectric RF filters will likely expand, with ongoing innovation in materials, device architectures, and manufacturing processes shaping the competitive landscape.

Future Outlook: Disruptive Opportunities and Long-Term Industry Impact

The future outlook for ferroelectric RF filter manufacturing in 2025 and the coming years is marked by significant disruptive opportunities and the potential for long-term industry transformation. Ferroelectric materials, such as barium strontium titanate (BST), are increasingly recognized for their tunable dielectric properties, enabling the development of agile, high-performance RF filters that address the growing demands of 5G, Wi-Fi 6/7, and emerging wireless standards. As the wireless ecosystem evolves, the need for compact, low-loss, and reconfigurable RF front-end components is driving both established players and innovative startups to invest in ferroelectric filter technologies.

Key industry leaders, including Murata Manufacturing Co., Ltd. and TDK Corporation, are actively advancing the integration of ferroelectric materials into RF filter products. These companies are leveraging their expertise in ceramic and thin-film technologies to develop tunable filters that can dynamically adapt to changing frequency bands, a critical requirement for next-generation mobile devices and infrastructure. Murata has highlighted the potential of BST-based components for miniaturized, high-frequency applications, while TDK continues to expand its portfolio of RF solutions targeting 5G and IoT markets.

In parallel, specialized firms such as Akoustis Technologies, Inc. are pioneering the commercialization of advanced ferroelectric and piezoelectric filter architectures. Akoustis is focused on high-frequency, high-power RF filters using proprietary materials and manufacturing processes, aiming to disrupt traditional surface acoustic wave (SAW) and bulk acoustic wave (BAW) filter markets. Their efforts underscore a broader industry trend toward leveraging novel material systems to achieve superior performance in terms of selectivity, insertion loss, and power handling.

Looking ahead, the adoption of ferroelectric RF filters is expected to accelerate as device manufacturers seek to overcome the limitations of conventional filter technologies. The ability to fabricate tunable, reconfigurable filters at scale will be crucial for supporting spectrum sharing, carrier aggregation, and dynamic network environments. Industry roadmaps suggest that by the late 2020s, ferroelectric-based filters could become standard in premium smartphones, small cells, and advanced wireless infrastructure, with further opportunities in defense, satellite, and automotive radar applications.

However, challenges remain in scaling up manufacturing, ensuring material reliability, and reducing production costs. Collaborative efforts between material suppliers, device manufacturers, and system integrators will be essential to unlock the full disruptive potential of ferroelectric RF filter technology and to shape the long-term trajectory of the wireless communications industry.

Sources & References

- Murata Manufacturing Co., Ltd.

- Skyworks Solutions, Inc.

- KEMET Corporation

- IEEE

- Akoustis Technologies, Inc.