Silicon Photonic Interconnects Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Forecasts. Explore Key Trends, Competitive Dynamics, and Strategic Opportunities Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Silicon Photonic Interconnects

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Market Barriers

- Opportunities and Strategic Recommendations

- Future Outlook: Emerging Applications and Long-Term Industry Impact

- Sources & References

Executive Summary & Market Overview

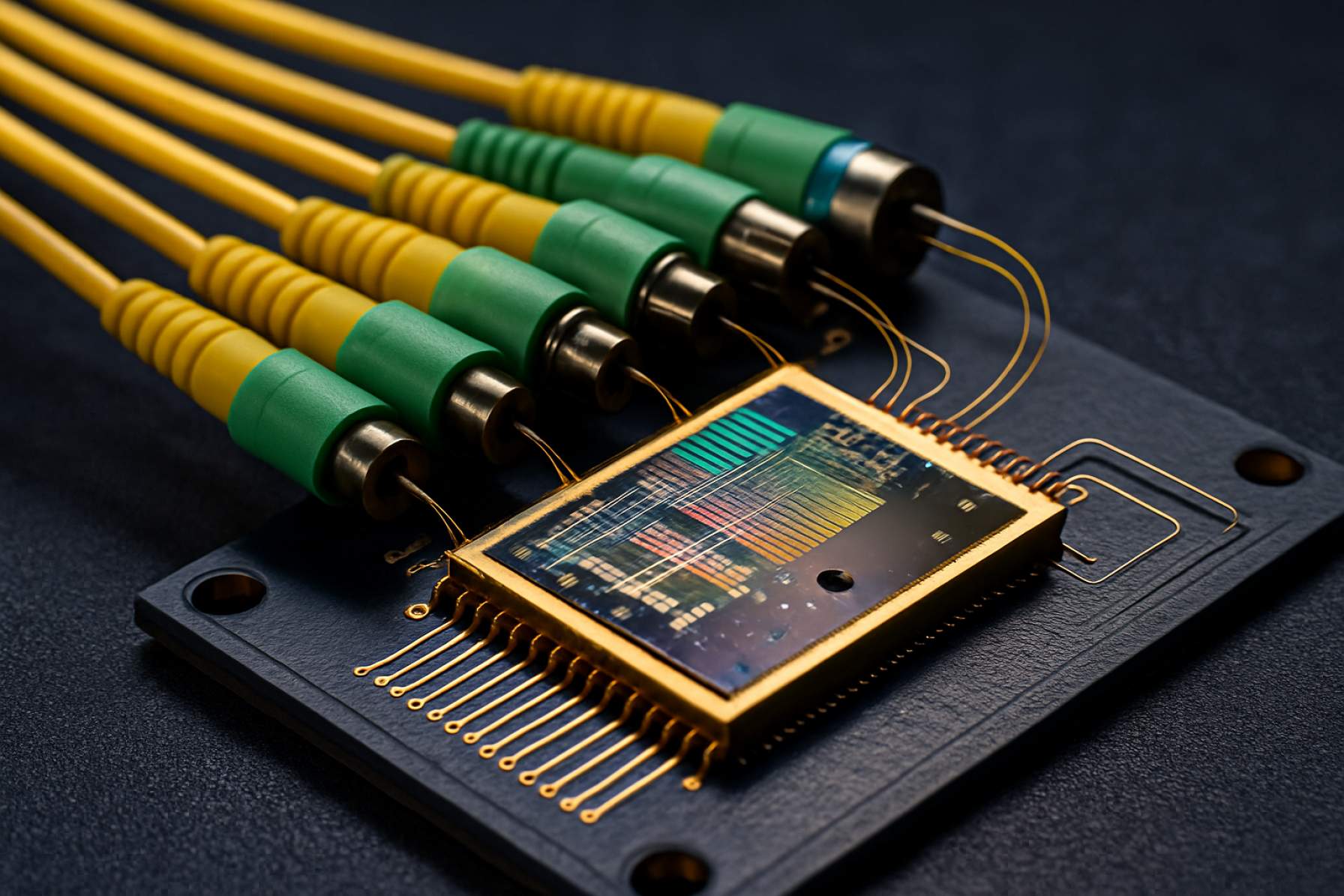

Silicon photonic interconnects represent a transformative technology in the field of data transmission, leveraging the optical properties of silicon to enable high-speed, low-power communication within and between electronic devices. As data centers, high-performance computing (HPC), and artificial intelligence (AI) workloads continue to scale, traditional copper-based interconnects face limitations in bandwidth, energy efficiency, and signal integrity. Silicon photonics addresses these challenges by integrating optical components onto silicon chips, facilitating faster and more efficient data transfer.

In 2025, the global silicon photonic interconnects market is poised for robust growth, driven by surging demand for high-bandwidth, low-latency connectivity in cloud computing, AI, and 5G infrastructure. According to MarketsandMarkets, the silicon photonics market is projected to reach USD 4.6 billion by 2025, growing at a CAGR of over 20% from 2020. This expansion is underpinned by the increasing adoption of optical transceivers, switches, and multiplexers in hyperscale data centers and enterprise networks.

Key industry players such as Intel Corporation, Cisco Systems, Inc., and Rockley Photonics are investing heavily in research and development to advance silicon photonic integration, reduce costs, and improve scalability. The technology’s compatibility with existing CMOS manufacturing processes further accelerates commercialization and deployment across various sectors.

- Data Centers: The proliferation of cloud services and exponential data growth are compelling operators to upgrade to silicon photonic interconnects for higher throughput and energy savings.

- Telecommunications: 5G rollouts and the need for high-speed backhaul are driving telecom providers to adopt optical interconnects for enhanced network performance.

- AI & HPC: The increasing complexity of AI models and HPC workloads necessitates ultra-fast, low-latency interconnects, positioning silicon photonics as a critical enabler.

Despite its promise, the market faces challenges such as integration complexity, packaging costs, and the need for standardization. However, ongoing innovation and strategic partnerships are expected to mitigate these barriers, paving the way for widespread adoption. In summary, 2025 marks a pivotal year for silicon photonic interconnects, with the technology set to redefine the landscape of high-speed data communication.

Key Technology Trends in Silicon Photonic Interconnects

Silicon photonic interconnects are rapidly transforming data transmission within data centers, high-performance computing (HPC), and telecommunications infrastructure. As the demand for higher bandwidth, lower latency, and energy-efficient data transfer intensifies, several key technology trends are shaping the silicon photonic interconnect landscape in 2025.

- Co-Packaged Optics (CPO): The integration of optical engines directly with switch ASICs is gaining momentum, reducing electrical link lengths and power consumption. Major industry players are advancing CPO solutions to address the limitations of traditional pluggable optics, with Intel and Broadcom leading initiatives to commercialize CPO for next-generation data center switches.

- Higher Data Rates: The transition to 800G and 1.6T optical modules is underway, driven by the need for faster interconnects in AI/ML clusters and cloud infrastructure. Silicon photonics enables dense integration of modulators and detectors, supporting these ultra-high-speed links. According to Credo, 1.6T solutions are expected to see initial deployments in 2025, with rapid scaling anticipated.

- Advanced Modulation Formats: To maximize spectral efficiency, silicon photonic interconnects are adopting advanced modulation schemes such as PAM4 and coherent signaling. These techniques allow for higher data throughput over existing fiber infrastructure, as highlighted in LightCounting’s 2024 market report.

- Integration with CMOS Electronics: The convergence of photonic and electronic components on a single chip is accelerating. This monolithic integration reduces packaging complexity and cost, while improving performance. GlobalFoundries and imec are at the forefront of developing CMOS-compatible silicon photonics platforms.

- Energy Efficiency and Sustainability: As data center energy consumption becomes a critical concern, silicon photonic interconnects are being optimized for lower power per bit. Innovations in laser integration, thermal management, and low-loss waveguides are central to these efforts, as noted by Analysys Mason.

These technology trends are collectively driving the adoption of silicon photonic interconnects, positioning them as a foundational technology for the next era of scalable, high-performance digital infrastructure.

Competitive Landscape and Leading Players

The competitive landscape for silicon photonic interconnects in 2025 is characterized by a dynamic mix of established semiconductor giants, specialized photonics firms, and emerging startups, all vying for leadership in a market driven by the exponential growth of data centers, high-performance computing, and AI workloads. The sector is witnessing rapid innovation, with companies racing to deliver higher bandwidth, lower latency, and improved energy efficiency.

Key players include Intel Corporation, which remains a dominant force due to its early investments in silicon photonics and its integration of optical interconnects into data center platforms. Intel’s co-packaged optics and transceiver modules are widely adopted by hyperscale cloud providers. Cisco Systems has also strengthened its position through acquisitions and the development of advanced optical networking solutions tailored for next-generation data centers.

Another major contender is Inphi Corporation (now part of Marvell Technology, Inc.), which has expanded its portfolio to include high-speed silicon photonic interconnects for cloud and AI infrastructure. Ayar Labs, a startup, is gaining traction with its optical I/O solutions that promise to overcome the bandwidth and power limitations of traditional electrical interconnects, attracting partnerships with leading chipmakers and system integrators.

In the Asia-Pacific region, NEC Corporation and Fujitsu Limited are investing heavily in silicon photonics R&D, targeting both domestic and global markets. European players such as STMicroelectronics and imec are leveraging their expertise in semiconductor manufacturing and photonic integration to develop next-generation interconnect solutions.

- Strategic partnerships and acquisitions are shaping the competitive landscape, with companies seeking to combine photonics expertise with large-scale manufacturing capabilities.

- Intellectual property portfolios and proprietary integration technologies are key differentiators, as firms aim to secure design wins with hyperscale data center operators and OEMs.

- Startups are driving disruptive innovation, particularly in co-packaged optics and chip-to-chip optical links, challenging incumbents to accelerate their R&D efforts.

According to MarketsandMarkets, the global silicon photonics market is projected to reach $4.6 billion by 2025, underscoring the intense competition and high growth potential in this sector.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The silicon photonic interconnects market is poised for robust growth between 2025 and 2030, driven by escalating demand for high-speed data transmission in data centers, telecommunications, and high-performance computing. According to projections by MarketsandMarkets, the global silicon photonics market is expected to register a compound annual growth rate (CAGR) of approximately 23% during this period, with interconnects representing a significant share of this expansion due to their critical role in enabling faster and more energy-efficient data transfer.

Revenue forecasts indicate that the silicon photonic interconnects segment will contribute substantially to the overall market, with global revenues anticipated to surpass $3.5 billion by 2030, up from an estimated $1.2 billion in 2025. This surge is attributed to the rapid adoption of optical transceivers and switches in hyperscale data centers, as well as the integration of silicon photonics in next-generation server and storage architectures. International Data Corporation (IDC) highlights that the increasing deployment of artificial intelligence (AI) and machine learning (ML) workloads is accelerating the need for high-bandwidth, low-latency interconnect solutions, further fueling market growth.

In terms of volume, the shipment of silicon photonic interconnect modules is projected to grow at a CAGR exceeding 25% from 2025 to 2030, as reported by Omdia. The proliferation of cloud computing and the transition to 400G and 800G optical modules are key factors driving this volume increase. Additionally, the ongoing shift from copper-based to optical interconnects in enterprise and edge computing environments is expected to bolster shipment numbers.

- Key growth drivers: Rising data traffic, energy efficiency requirements, and the need for scalable interconnect solutions in data-intensive applications.

- Regional outlook: North America and Asia-Pacific are projected to lead market growth, with significant investments in data center infrastructure and photonic R&D.

- Technology trends: Advancements in co-packaged optics and integration of photonic components at the chip level are anticipated to further accelerate adoption rates.

Overall, the 2025–2030 period is expected to witness accelerated growth in both revenue and volume for silicon photonic interconnects, underpinned by technological innovation and expanding application domains.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global silicon photonic interconnects market is poised for significant growth in 2025, with regional dynamics shaped by technological adoption, data center expansion, and government initiatives. The market is segmented into North America, Europe, Asia-Pacific, and Rest of World, each exhibiting distinct trends and growth drivers.

- North America: North America is expected to maintain its leadership in the silicon photonic interconnects market in 2025, driven by the presence of major technology companies, robust investments in data centers, and early adoption of advanced optical technologies. The U.S. remains the epicenter, with hyperscale data center operators such as Microsoft, Google, and Amazon integrating silicon photonics to meet escalating bandwidth and energy efficiency demands. Additionally, government-backed R&D initiatives and collaborations with leading universities further accelerate innovation in this region (Grand View Research).

- Europe: Europe is witnessing steady growth, underpinned by the region’s focus on digital infrastructure modernization and sustainability. The European Union’s digital strategy and funding for next-generation communication networks are catalyzing adoption, particularly in Germany, the UK, and France. European semiconductor firms and research consortia are actively developing silicon photonic solutions for both data center and telecom applications. The region’s emphasis on energy-efficient technologies aligns well with the advantages offered by silicon photonic interconnects (IDC).

- Asia-Pacific: Asia-Pacific is projected to be the fastest-growing region in 2025, fueled by rapid digital transformation, 5G rollout, and the proliferation of cloud services. China, Japan, and South Korea are at the forefront, with significant investments in hyperscale data centers and government support for semiconductor innovation. Leading regional players, such as Huawei and NEC, are advancing silicon photonic integration to address the surging demand for high-speed, low-latency interconnects (MarketsandMarkets).

- Rest of World: The Rest of World segment, including Latin America, the Middle East, and Africa, is in the nascent stage of adoption. Growth is primarily driven by increasing investments in digital infrastructure and gradual expansion of cloud and telecom services. While the market share remains modest, rising awareness and pilot deployments are expected to lay the groundwork for future growth (Fortune Business Insights).

Challenges, Risks, and Market Barriers

Silicon photonic interconnects, while promising transformative advances in data transmission speed and energy efficiency, face several significant challenges, risks, and market barriers as of 2025. One of the primary technical challenges is the integration of photonic components with existing CMOS manufacturing processes. Achieving high-yield, cost-effective production of silicon photonic devices that are compatible with standard semiconductor fabrication remains complex, often requiring specialized equipment and process modifications that can increase costs and limit scalability (Intel Corporation).

Another major barrier is the packaging and assembly of silicon photonic devices. Optical alignment tolerances are much tighter than those for traditional electronic interconnects, making packaging a critical cost and reliability factor. The need for precise fiber-to-chip and chip-to-chip alignment increases manufacturing complexity and can hinder mass adoption (Yole Group).

Thermal management also presents a risk, as photonic devices are sensitive to temperature fluctuations, which can affect wavelength stability and overall performance. Integrating efficient thermal control solutions without significantly increasing power consumption or footprint is a persistent challenge for system designers (Synopsys, Inc.).

From a market perspective, the high initial investment required for research, development, and production infrastructure poses a barrier, particularly for smaller players. The ecosystem for silicon photonics is still maturing, with limited availability of standardized components and design tools, which can slow down innovation and increase time-to-market (MarketsandMarkets).

There are also risks related to interoperability and standardization. The lack of universally accepted standards for silicon photonic interconnects can lead to compatibility issues between products from different vendors, impeding widespread adoption in data centers and high-performance computing environments (International Electrotechnical Commission (IEC)).

Finally, market adoption is influenced by the pace at which end-users, such as hyperscale data centers and telecom operators, are willing to transition from established copper and traditional optical solutions to silicon photonics. Concerns about long-term reliability, supply chain maturity, and return on investment continue to temper enthusiasm, despite the technology’s potential (LightCounting Market Research).

Opportunities and Strategic Recommendations

The market for silicon photonic interconnects in 2025 is poised for significant expansion, driven by escalating data center demands, the proliferation of artificial intelligence (AI) workloads, and the transition to next-generation network architectures. Key opportunities are emerging in hyperscale data centers, high-performance computing (HPC), and telecommunications, where the need for higher bandwidth, lower latency, and energy efficiency is paramount.

One of the most promising opportunities lies in the adoption of co-packaged optics (CPO), which integrates photonic and electronic components within a single package. This approach addresses the limitations of traditional pluggable optics, enabling higher data rates and reduced power consumption. Major industry players, such as Intel and Cisco Systems, are actively investing in CPO development, anticipating its deployment in next-generation switches and servers by 2025. The Open Compute Project’s CPO initiative further underscores the strategic importance of this technology for hyperscale operators (Open Compute Project).

Another strategic opportunity is the integration of silicon photonics with advanced packaging technologies, such as 3D stacking and chiplet architectures. This enables modular, scalable interconnect solutions that can be tailored to specific application requirements, supporting the rapid evolution of AI and machine learning workloads. Companies like AMD and NVIDIA are exploring these architectures to enhance the performance and efficiency of their data center offerings.

To capitalize on these opportunities, market participants should consider the following strategic recommendations:

- Invest in R&D for CPO and advanced packaging to stay ahead of the technology curve and meet the evolving needs of hyperscale and HPC customers.

- Forge partnerships with foundries and packaging specialists to accelerate time-to-market and ensure supply chain resilience.

- Engage with industry consortia, such as the Open Compute Project and Connectivity Standards Alliance, to influence standards and foster interoperability.

- Develop application-specific solutions for emerging markets, including AI accelerators, edge computing, and 5G/6G infrastructure, where silicon photonic interconnects can deliver differentiated value.

In summary, 2025 presents a pivotal year for silicon photonic interconnects, with substantial opportunities for innovation and market leadership for those who strategically invest in next-generation technologies and ecosystem collaboration.

Future Outlook: Emerging Applications and Long-Term Industry Impact

Looking ahead to 2025 and beyond, silicon photonic interconnects are poised to play a transformative role across multiple technology sectors, driven by the relentless demand for higher data rates, lower latency, and improved energy efficiency. As data centers, high-performance computing (HPC), and artificial intelligence (AI) workloads continue to scale, the limitations of traditional copper-based interconnects become increasingly apparent. Silicon photonics, leveraging mature CMOS fabrication processes, offers a scalable and cost-effective solution to these bottlenecks.

Emerging applications in 2025 are expected to include not only intra- and inter-data center connectivity but also advanced AI accelerators, chiplet architectures, and even quantum computing interfaces. The integration of silicon photonic interconnects within AI and machine learning hardware is particularly promising, as these systems require massive bandwidth and low-latency communication between processing units. Industry leaders such as Intel and NVIDIA are actively investing in silicon photonics to enable next-generation AI platforms, with prototypes already demonstrating significant performance gains over electrical interconnects.

Another key trend is the adoption of co-packaged optics (CPO), where optical transceivers are integrated directly with switch ASICs. This approach, championed by companies like Cisco and Broadcom, is expected to become mainstream by 2025, enabling switch fabrics with aggregate bandwidths exceeding 51.2 Tbps while reducing power consumption and thermal challenges. The Organic and Printed Electronics Association (OE-A) and Road to VR also highlight the potential for silicon photonics in emerging fields such as augmented reality (AR), virtual reality (VR), and high-speed sensor networks, where compact, high-bandwidth optical links are essential.

Long-term, the industry impact of silicon photonic interconnects extends to enabling new computing paradigms. As IDC and Gartner forecast, the proliferation of edge computing and 6G networks will further drive demand for high-speed, low-power optical interconnects. The convergence of photonics and electronics at the chip level is expected to unlock unprecedented system architectures, reduce total cost of ownership for hyperscale operators, and accelerate innovation in fields ranging from genomics to autonomous vehicles.

In summary, by 2025, silicon photonic interconnects will not only address current data bottlenecks but also catalyze new applications and business models, fundamentally reshaping the landscape of digital infrastructure.

Sources & References

- MarketsandMarkets

- Cisco Systems, Inc.

- Rockley Photonics

- Broadcom

- LightCounting

- imec

- Analysys Mason

- Inphi Corporation

- Marvell Technology, Inc.

- Ayar Labs

- NEC Corporation

- Fujitsu Limited

- STMicroelectronics

- International Data Corporation (IDC)

- Microsoft

- Amazon

- Grand View Research

- Huawei

- Fortune Business Insights

- Synopsys, Inc.

- Open Compute Project

- NVIDIA

- Connectivity Standards Alliance

- Organic and Printed Electronics Association (OE-A)

- Road to VR